Get the free account form bid

Show details

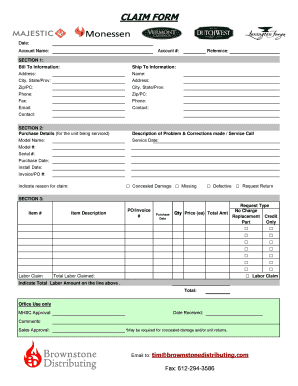

BID ASSISTANCE CLAIM FORM Southeast, Inc. Modified December 2009 ? Please use only the most current Bid Claim Form 2304 W. Taft Vineland Road Orlando, FL 32837 1-800-356-6833 Dealer Acct. No. Claim

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your account form bid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your account form bid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit account form bid online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit account form auction. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out account form bid

How to fill out a credit form:

01

Gather all necessary documents such as identification proof, employment details, and financial information.

02

Read the instructions carefully and understand the requirements of the credit form.

03

Start by providing personal information like name, address, contact details, and social security number.

04

Fill in your employment details including current occupation, employer's name, and contact information.

05

Provide accurate information about your income, including salary, bonuses, and any additional sources of income.

06

Declare your expenses, such as monthly rent or mortgage payments, utility bills, and any outstanding debts.

07

Specify the type of credit you are applying for, whether it's a loan, credit card, or mortgage.

08

Carefully review the form for any errors or missing information before submitting it.

Who needs a credit form:

01

Individuals who are applying for a loan from a financial institution.

02

People who want to open a credit card account.

03

Individuals who are interested in obtaining a mortgage for purchasing a property.

04

Business owners who need to apply for a line of credit or business loan.

05

Those who are looking to refinance an existing loan or consolidate their debts.

Fill program form auction : Try Risk Free

People Also Ask about account form bid

How to fill out a 5695 form?

What is form 8880 used for?

Who needs to file form 3800?

What is credit form 3800?

What is a business credit form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit form?

Credit form refers to a physical or electronic document used by lending institutions, such as banks or credit unions, to gather information from individuals or businesses applying for credit. This form typically includes fields to input personal identification details, financial information, employment history, and other relevant information needed to assess the applicant's creditworthiness.

How to fill out credit form?

Filling out a credit form may vary depending on the specific form or application you are using. However, here are some general steps to follow:

1. Read the instructions: Before you start filling out the form, read the instructions carefully. This will help ensure that you provide the correct information and follow any specific guidelines mentioned.

2. Personal information: Start by filling in your personal details such as your full name, address, phone number, and social security number. Be sure to provide accurate and up-to-date information.

3. Employment information: Include your current employment details, such as your employer's name, address, and contact information. You may also need to provide information about your position, length of employment, and income.

4. Financial information: Provide details about your financial situation, including your current assets, savings, investments, and any outstanding debts or loans. Be thorough and honest while disclosing this information.

5. Credit references: If the form asks for credit references, provide the names, addresses, and contact information of individuals or companies that can vouch for your creditworthiness.

6. Agreement and signature: Read the terms and conditions carefully, including any legal disclosures or notices. If you agree to the terms, sign and date the form where indicated. Make sure to understand the implications of signing the form.

7. Review and double-check: Before submitting the form, review all the information you have entered. Ensure there are no errors or omissions and that everything is accurate.

8. Attach supporting documents: If required, attach any supporting documents requested, such as proof of income (e.g., pay stubs or tax returns) or identification documents (e.g., driver's license or passport).

Remember, this is a general guideline, and the specific credit form you are filling out may have additional or different requirements. Always carefully read the instructions provided with the form and seek clarification if needed.

What is the purpose of credit form?

The purpose of a credit form is to gather information about an individual's credit history, financial status, and personal information for the purpose of assessing their creditworthiness. Lenders, such as banks or credit card companies, use credit forms to evaluate the risk involved in extending credit to a borrower. The information provided on the credit form helps determine whether the borrower will be able to repay the borrowed funds or meet the financial obligations associated with credit transactions.

What information must be reported on credit form?

When filling out a credit form, the following information is typically required:

1. Personal Information: Full name, date of birth, social security number (or equivalent identification number), and current contact information (address, phone number, and email).

2. Employment Information: Current employer's name, address, phone number, job title, and length of employment.

3. Financial Information: Monthly income (from all sources), details of other financial obligations (such as rent, mortgage payments, and other loans), and any additional sources of income.

4. Residential Information: Current and previous residential addresses, length of time at each address, and whether you own or rent.

5. Credit History: Details of previous credit accounts, such as credit cards, loans, and mortgages, including the names of lenders, account numbers, payment history, balances, and current status.

6. Identification Documents: Copy of a valid government-issued identification document (e.g., driver's license, passport) to verify identity.

7. References: Names, addresses, and phone numbers of references who can vouch for your character and creditworthiness.

It's important to note that the specific information required may vary depending on the purpose of the credit form and the institution requesting it. Additionally, additional documents and background checks may be required for certain types of credit applications, such as mortgage or business loans.

What is the penalty for the late filing of credit form?

The penalty for the late filing of a credit form can vary depending on the specific jurisdiction and circumstances. In general, late filing can result in additional fees, increased interest rates, and potentially negative impacts on the individual's credit score. It is best to consult the specific guidelines and regulations of the relevant credit institution or governing body to determine the exact penalty for late filing.

How can I manage my account form bid directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your account form auction along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get form auction bid?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific credit bid and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in card credit bid without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing credit bid payment form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your account form bid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Auction Bid is not the form you're looking for?Search for another form here.

Keywords relevant to credit assistance auction form

Related to assistance form auction

If you believe that this page should be taken down, please follow our DMCA take down process

here

.